17+ Subprime mortgage

The Department of Justice today filed the second largest fair lending settlement in the departments history to resolve allegations that Wells Fargo Bank the largest residential home mortgage originator in the United States engaged in a pattern or practice of discrimination against qualified African-American and Hispanic borrowers in its mortgage. If anything the above tables understate the current dominance of the 30 year FRM.

Travis Defries Windermere Real Estate Home Facebook

A real estate bubble is a type of economic bubble that occurs periodically in local regional national or global real estate markets.

. By January 2008 the delinquency rate had risen. The origins of modern residential mortgage-backed securities can be traced back to the Government National Mortgage Association although variations on mortgage securitization existed in the US. On December 17 2018 Malaysia filed criminal charges against subsidiaries of Goldman and their former employees Leissner and Ng alleging their commission of misleading statements in order to dishonestly.

Impact on Europe Public debt to GDP ratio for selected European. In 2007 it filed for bankruptcy protection. Historically subprime borrowers were defined as having FICO scores below 600 although this threshold has varied over time.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week. Todays national mortgage rate trends.

It includes United States enactment of government laws and regulations as well as public and private actions which. Chapter 17 - Government Budgets and Fiscal Policy. The value of US.

In finance subprime lending also referred to as near-prime subpar non-prime and second-chance lending is the provision of loans to people in the United States who may have difficulty maintaining the repayment schedule. Deutsche Bank was founded in Berlin in 1870 as a specialist bank for financing foreign trade and promoting German exports. In the late 1800s and early 1900sIn 1968 Ginnie Mae was the first to issue a new type of government-backed bond known as the residential mortgage-backed security.

Conventional mortgage insurance called PMI private mortgage insurance typically costs between 30 and 70 for every 100000 you borrow and is paid as part of your monthly payment. Of the total number of auto loans and leases outstanding the share of borrowers with subprime credit ratings credit scores of 501-600 has dropped from 185 in 2017 to a share of 145 in Q2 2022 red line in. Conflicts causing at least 1000 deaths in one calendar year are considered wars by the Uppsala Conflict Data Program.

As a result of its involvement in securitization during the subprime mortgage crisis. 6172021 - The 2020 HMDA national loan-level data products and aggregate. The 30-year mortgage is the most popular choice because it offers the lowest monthly payment.

For example a deep-subprime borrower might have improved their credit score from 450 to 520 thereby moving up into subprime. Or Citi stylized as citi is an American multinational investment bank and financial services corporation headquartered in New York CityThe company was formed by the merger of banking giant Citicorp and financial conglomerate Travelers Group in 1998. It subsequently played a large part in developing Germanys industry as its business model focused on providing finance to industrial customers.

Travelers was subsequently spun off from the company in 2002. The subprime mortgage crisis impact timeline lists dates relevant to the creation of a United States housing bubble and the 2005 housing bubble burst or market correction and the subprime mortgage crisis which developed during 2007 and 2008. Subprime mortgage company New Century Financial made nearly 60 billion in loans in 2006 according to the Reuters news service.

The following commercial shows how a 31 IO styled subprime mortgage might have been marketed during the bubble. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. Subprime mortgages was estimated at 13 trillion as of March 2007 with over 75 million first-lien subprime mortgages outstanding.

Several major financial institutions collapsed in September 2008 with significant. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. Other sets by this creator.

Approximately 16 of subprime loans with adjustable rate mortgages ARM were 90-days delinquent or in foreclosure proceedings as of October 2007 roughly triple the rate of 2005. The Home Mortgage Disclosure Act HMDA was enacted by Congress in 1975 and was implemented by the Federal Reserve Boards Regulation C. The banks statute was adopted on 22 January 1870 and on 10 March 1870 the Prussian.

After 8 years the fsagovuk redirects will be switched off on 1 Oct 2021 as part of decommissioning. National averages of the lowest jumbo mortgage rates offered by more than 200 of the countrys top lenders with a loan-to-value ratio LTV of 80 an applicant with a FICO credit score of 700. After reports of the subprime mortgage crisis began to appear in the media which of the following most likely caused housing prices to fall.

Subprime mortgage crisis was a set of events and conditions that led to a financial crisis and subsequent recession that began in 2007. New vehicle sales which peaked at 17 million in 2005 recovered to only 12 million by 2010. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

Pros and cons of Fannie Mae guidelines. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. On July 21 2011 the rule-writing authority of Regulation C was transferred to the Consumer Financial Protection Bureau CFPB.

Adjustable-rate mortgages went out of favor with many financial planners after the subprime. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of. United States housing prices experienced a major market correction after the housing bubble that peaked in early 2006Prices of real estate then adjusted downwards in late 2006 causing a loss of market liquidity and subprime defaults.

Citigroup owns Citicorp the holding. It was characterized by a rise in subprime mortgage delinquencies and foreclosures and the resulting decline of securities backed by said mortgages. Mortgage loan basics Basic concepts and legal regulation.

Wars 10009999 combat-related deaths in current or past year The 17 conflicts in the following list have caused at least 1000 and fewer than 10000 direct violent deaths in a current or past calendar year.

21 Mortgage Statistics That Come As No Surprise In 2022

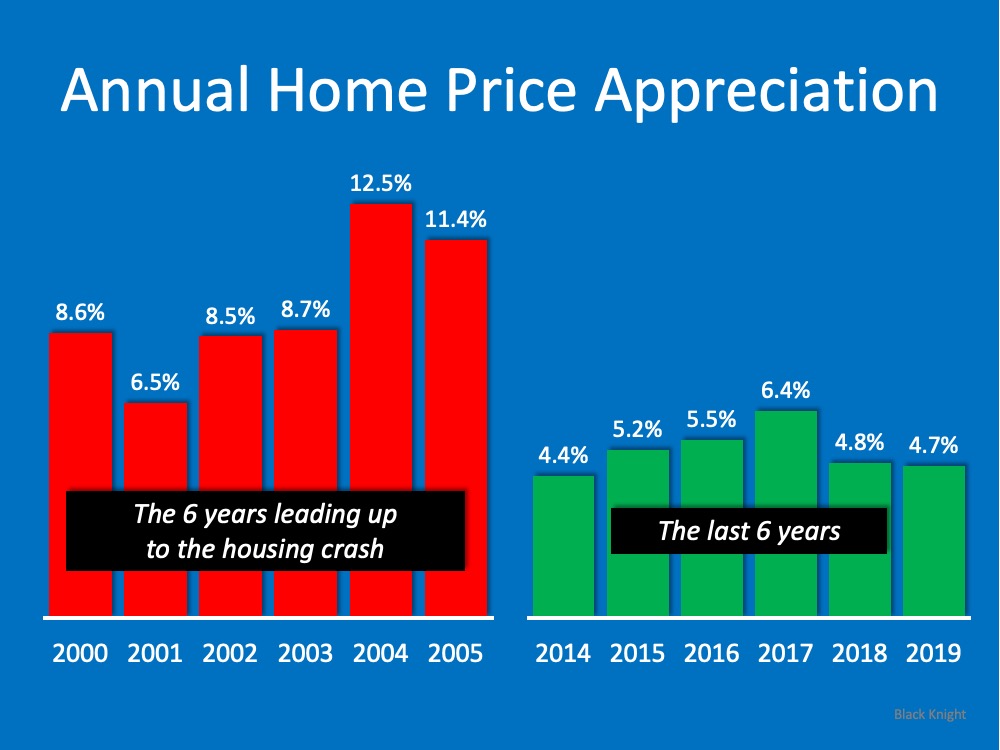

Think This Is A Housing Crisis Think Again Blog Samit Shah The Samit Team

San Diego California Mortgage Rates Loan Officer Kevin O Connor

Under The Hood Of A Remic Subprime Mortgage Subprime Mortgage Crisis Mortgage Info

San Jose California Mortgage Rates Loan Officer Kevin O Connor

How Long Does A Refinance Take Loan Officer Kevin O Connor

The Most Dangerous Bank In America Market Mad House Subprime Mortgage Subprime Mortgage Crisis Credit Default Swap

Identifying And Trading A Bear Market

Today S Mortgage Rates In California Loan Officer Kevin O Connor

American Homes Underwater Subprime Mortgage Crisis Jenns Blah Blah Blog Subprime Mortgage Crisis Mortgage Underwater

The Loan Process Bill Mervin Team At Apex Home Loan

Identifying And Trading A Bear Market

Casualties Of The Financial Crisis Subprime Mortgage Crisis Financial Financial Services

Bluprint Home Loans Home Facebook

About Rick Orlando Mortgage Buyers Refinancing

Los Angeles California Mortgage Rates Loan Officer Kevin O Connor

Think This Is A Housing Crisis Think Again Blog Samit Shah The Samit Team